Business Insurance in and around Oklahoma City

Looking for coverage for your business? Look no further than State Farm agent Devin Smith!

Helping insure businesses can be the neighborly thing to do

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes problems like an employee getting hurt can happen on your business's property.

Looking for coverage for your business? Look no further than State Farm agent Devin Smith!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

With options like extra liability, worker's compensation for your employees, errors and omissions liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Devin Smith is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does happen.

Don’t let concerns about your business stress you out! Contact State Farm agent Devin Smith today, and learn more about how you can meet your needs with State Farm small business insurance.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

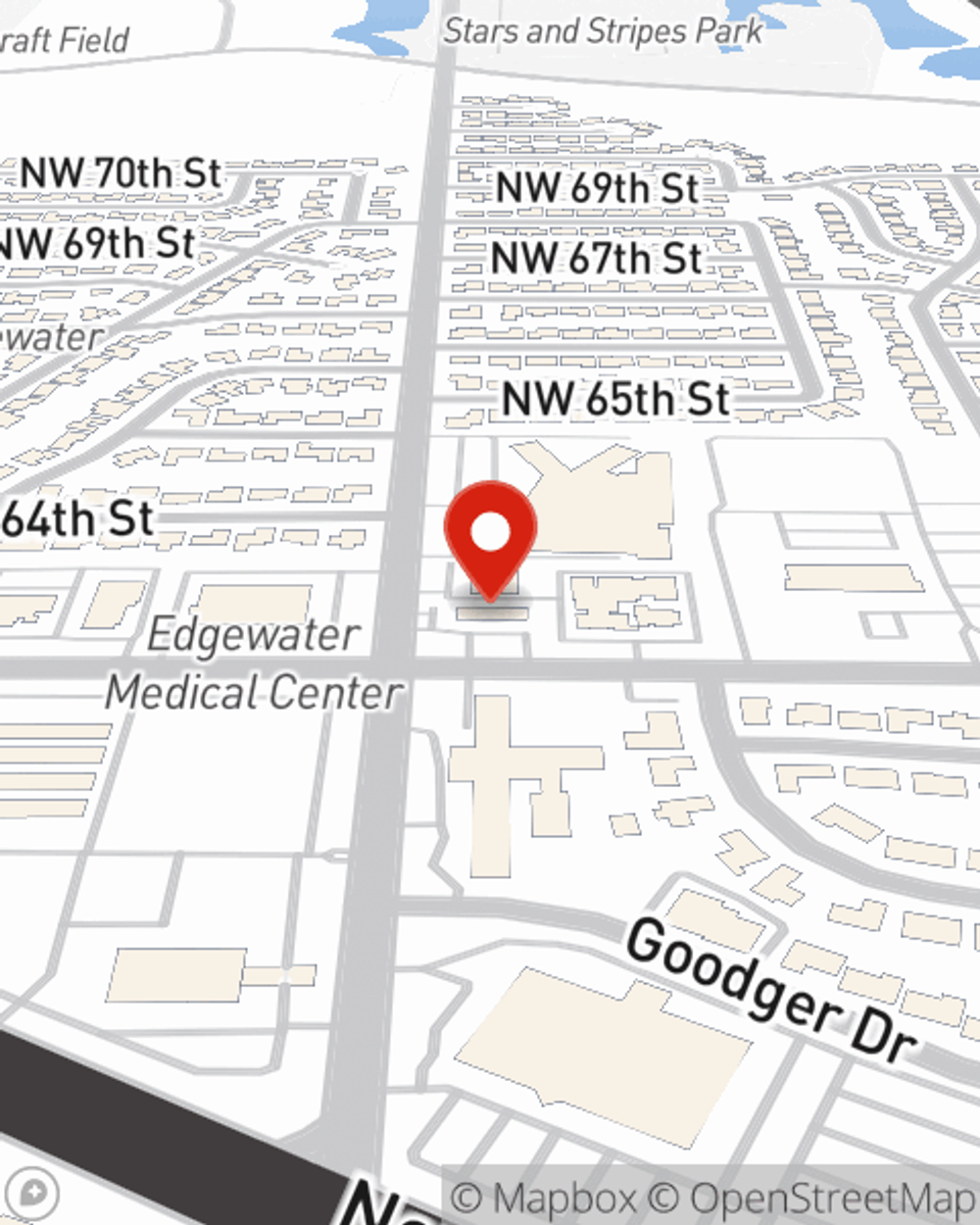

Devin Smith

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.